Government debtSimilar to an insolvent company, there must be a settlement procedure. Both the granting of the loans and the repayment are based on unrealistic assumptions.

A young man comes to the bank. "I need a 200,000 EUR loan". The banker asks the young man "How much do you earn?", "1500 per month". The banker then asks "How will you ever be able to pay back a 200,000 EUR loan with only 1500 per month? The young man full of conviction: "I will soon earn twice as much". The banker pushes a credit agreement over the table "Please sign here, if you soon earn twice as much, then it's no problem".

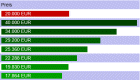

According to the EU Treaty, member states are allowed to incur new debt of 3% of GDP each year. How are these debts, which are growing by 3% a year, to be paid back? No problem, the economy is growing, tax revenues are growing, just like the young man on the bank, who thought he would soon earn twice as much.

20 years later, the young man is now 20 years older and filed for private bankruptcy. The outstanding loan is still 200,000 EUR. All these years he has only laboriously managed to pay the interest. The dream of 3000 EUR income per month is long gone. He has laboriously increased his income to 2000. But he doesn't get anything from it, because the costs for the oil heating and for the journeys to work have also become 500 EUR more expensive per month.

The interest on government debt can only be paid because the interest rate level is extremely low. Supply and demand determine not only the price, but also the interest rate. Due to the economic blockade, almost nothing is invested in the real economy, the demand for money is very low, as are interest rates. In an economic boom, however, the demand for loans would be very high and lending rates would rise. At a higher interest rate level, however, countries would no longer be able to pay interest on their debts.

This is precisely what the negotiation strategy for a compensation procedure must aim at. What is better? 100% of the claim in the case of a gradually declining state or 10% of the claim in the case of a state in an economic boom that can service both outstanding capital and significantly higher interest rates? |